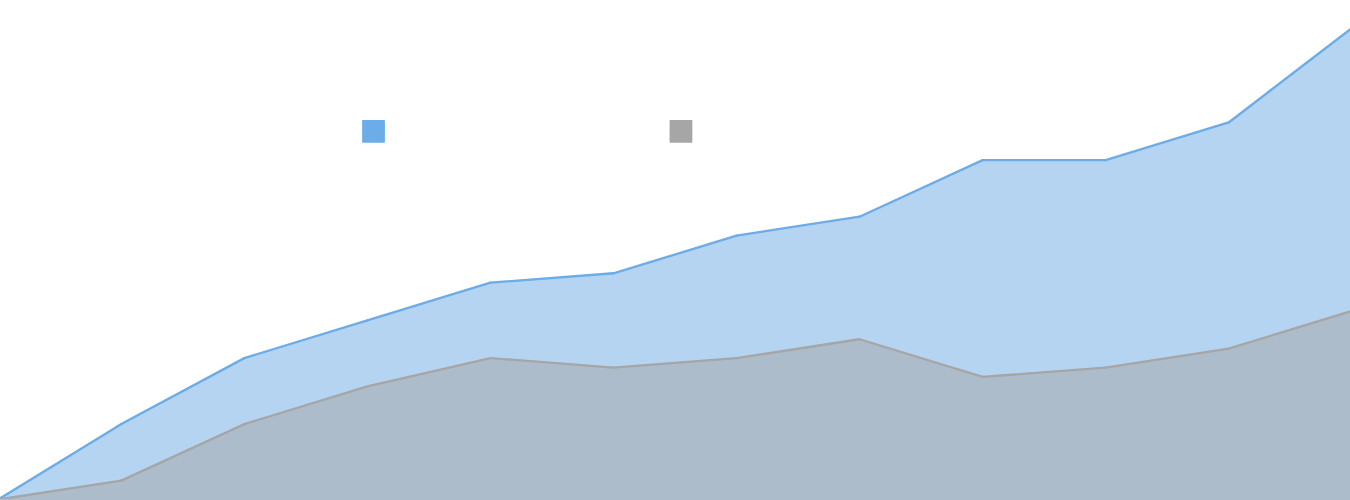

*Assuming 5% annualized hypothetical growth of 500k portfolio vs 8% hypothetical annualized growth of advisor-managed portfolio over 25 years. Based on a 2022 Vanguard study titled, “Putting a value on your value: Quantifying Vanguard Advisor’s Alpha” implementing Vanguard’s Advisor Alpha framework can add up to, or even exceed, 3% net of returns. Click here to access the full research report in its entirety.

The information contained above is for illustrative purposes only. The above targets are estimates based on certain assumptions and analysis made by the advisor. There is no guarantee that the estimates will be achieved. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

FAQs

The annual fee starts at 1% of assets and decreases at higher asset levels (see chart). Enrollment minimum is $500,000. Fees for your enrolled account are based on daily asset levels and are applied at the end of each month. There are no withdrawal fees. We are a fee-only advisor, meaning we do not earn commissions. Our fees are based on a percentage of assets under management along with fixed rates for financial plans.

| Billable Assets | Annual Fee Schedule (billed monthly) |

|---|---|

| First $2 million* | 1.00% |

| Next $3 million (more than $2M up to $5M) | 0.80% |

| Next $5 million (more than $5M up to $10M) | 0.70% |

| Next $15 million (more than $10M up to $25M)** | 0.60% |

| Assets over $25 million | 0.50% |

*Subject to a minimum annual fee of $6,000

** Tax filing and Estate Planning to include creation of, updating, drafting or answering questions provided at no additional cost.

| Additional Services | Cost |

|---|---|

| Tax Filing | Pricing varies based on complexity |

|

Estate Planning & Preparation (Unlimited Access) Our best-in-class estate planning document offering includes:

|

$1,490 |